Self-Help Group (History, Functions, Benefits, Case Studies, Examples)

Self-Help Group (SHG’s) represent a unique and impactful intermediary in the development process, particularly for women. These groups, often formed and supported by NGOs or government agencies, play a crucial role in empowering women on social, economic, and political fronts.

With an emphasis on micro-credit, the proliferation of SHG’s is a significant development in the country, with around seven million such groups. SHGs serve as conduits for government-sponsored development initiatives, providing women with access to credit, fostering collective building, and enabling participation in various schemes.

The emergence of SHGs has garnered interest from NGOs, corporations, and government agencies, recognising their role in empowering poor women and ensuring their right to credit for various needs, including education and healthcare. Participation in SHGs opens up opportunities for mobility and leadership roles for women in the public sphere.

History of Self-Help Group

In the mid-1970s, the concept of Self-Help Groups (SHGs) began its journey, finding its roots in the innovative efforts of Professor Mohammed Yunus in Bangladesh. At that time, he initiated women’s groups with a unique vision – to encourage thrift and savings among the poorest in society. This humble beginning marked the birth of what later transformed into the renowned Grameen Bank.

Initially formed in 1976, Grameen Bank went beyond conventional banking. It focused on lending not to individuals but to small groups, predominantly comprising women, who aspired to establish small businesses. These groups, eventually known as SHGs, operated as close-knit financial communities, relying on mutual trust and cooperation. Grameen Bank’s success was evident in its extensive reach, boasting thousands of branches and covering millions of villages.

The model gained recognition globally, inspiring similar initiatives in other parts of the world, including India. NGOs and organisations in India, impressed by the success of Grameen Bank, began organising SHGs as a means to empower economically disadvantaged individuals, particularly women.

These SHGs, born out of the Grameen Bank’s pioneering efforts, have since played a pivotal role in poverty alleviation across rural India. They serve as more than just financial entities, fostering a sense of community and providing a platform for individuals, especially women, to actively engage in savings, credit activities, and various socio-economic initiatives.

“Gentle Revolutionary” – Ilaben Bhat

Ilaben Bhat – Founded Self-Employed Women’s Association of India in 1972

In the dynamic landscape of the 1970s, a trailblazer named Ilaben Bhat emerged as a driving force for change in India. Recognizing the inherent strength of women, she played a pivotal role in founding the ‘Self Employed Women’s Association’ or SEWA in Ahmedabad.

Ilaben Bhat, a visionary leader, foresaw the transformative potential of women’s empowerment, particularly in economically challenging environments. SEWA, under her guidance, began as a union dedicated to supporting women employed in the unorganised sector. However, it quickly evolved to make significant contributions to the burgeoning Self-Help Group (SHG) movement in India.

Ilaben Bhat’s notable impact came through the introduction of the ‘women and microfinance’ concept. This innovative approach aimed to provide financial resources to empower women. Following SEWA’s lead, similar organisations like ‘Annapurna Mahila Mandal’ in Maharashtra and the ‘Working Women’s Forum’ in Tamil Nadu embraced and expanded upon this vision.

These organisations, led by Ilaben Bhat’s principles, became instrumental in the establishment and growth of SHGs across India. Beyond advocating for women’s rights, they actively facilitated the formation of SHGs, creating platforms for women to save, access credit, and establish a robust support system.

Ilaben Bhat’s leadership in promoting SHGs in Ahmedabad showcased a holistic approach that not only empowered women economically but also fostered community development, skill enhancement, and social changes like:

- Economic Empowerment: Through SEWA, Ilaben Bhat spearheaded the formation of SHGs, enabling women in Ahmedabad to pool their resources and access microfinance. This empowered them to start and expand small businesses, ranging from tailoring and handicrafts to agriculture.

- Community Building: SHGs became a catalyst for community cohesion. Women in Ahmedabad, brought together by common economic goals, formed strong bonds through regular meetings, discussions, and collaborative initiatives. This sense of community fostered support networks, boosting morale and resilience.

- Skill Development: Ilaben Bhat emphasised skill development within SHGs. Women were trained in various trades, enhancing their capabilities. For instance, training programs in Ahmedabad equipped women with tailoring skills, turning them into skilled entrepreneurs with sustainable livelihoods.

- Financial Inclusion: SEWA’s SHGs facilitated financial inclusion in Ahmedabad. Women, who were once excluded from formal banking, gained access to credit and banking services. This inclusion not only empowered them economically but also enhanced their financial literacy.

- Gender Equality Advocacy: Ilaben Bhat’s leadership promoted gender equality within SHGs. Women in Ahmedabad were encouraged to take leadership roles, challenging traditional gender norms. This shift had a broader impact on societal perceptions of women’s capabilities.

- Entrepreneurship Boost: SHGs provided a platform for aspiring entrepreneurs in Ahmedabad. Women who started with small ventures, like home-based businesses, gradually expanded their enterprises. Some successfully transitioned to larger enterprises, contributing to the local economy.

- Social Welfare Initiatives: SHGs in Ahmedabad, inspired by SEWA’s ethos, engaged in social welfare initiatives. They initiated programs related to health, education, and community development, showcasing the broader societal impact beyond economic aspects.

- Resilience to Shocks: Through collective savings in SHGs, women in Ahmedabad built a financial cushion. This resilience became evident during challenging times, such as natural disasters or economic downturns, where SHG members could support each other.

- Replication of Model: The success of SHGs in Ahmedabad became a model for replication in other regions. Ilaben Bhat’s vision influenced the expansion of SHG initiatives across India, demonstrating the scalability and adaptability of the model.

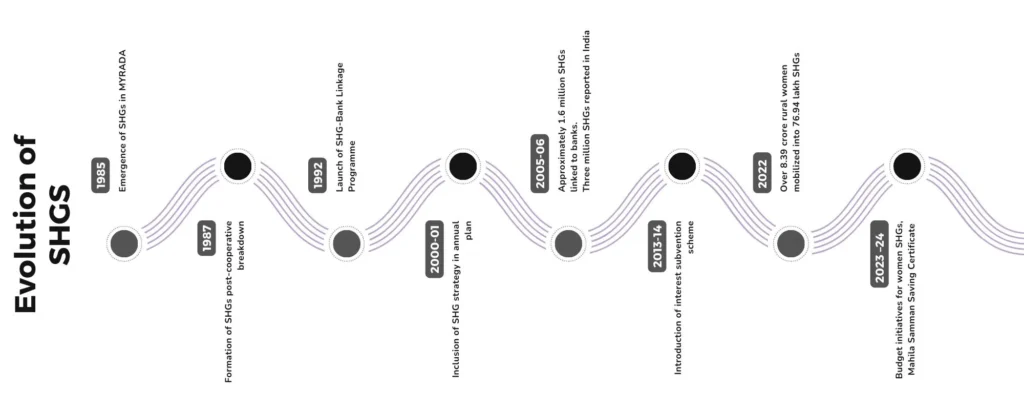

Evolution of Self-Help Group (SHGs) in India

The Early Years (1985-1987):

In the mid-1980s, something significant was brewing in India’s Mysore Resettlement and Development Agency (MYRADA). It marked the birth of Self Help Groups (SHGs), a concept emerging from the breakdown of large cooperatives. Members facing loan repayment challenges approached MYRADA, which had a unique suggestion—they could form smaller groups. This led to the inception of SHGs. These groups, composed of 15-20 members, learned to manage their finances, organise meetings, and build trust among themselves.

Phase I: From 1987 to 1992:

During the late ’80s to early ’90s, the National Bank for Agriculture and Rural Development (NABARD) took a keen interest in supporting Non-Governmental Organization (NGO) initiatives for SHGs. In 1987, MYRADA received funds from NABARD to identify affinity groups and match their savings. The Reserve Bank of India (RBI) recognized the SHG strategy as an alternative credit model in 1990. This laid the groundwork for the official launch of the SHG-Bank Linkage Programme in 1992.

Phase II: From 1992 Onwards – SHG-Bank Linkage Programme:

In 1992, the SHG-Bank Linkage Programme kicked off with a two-year pilot project. Over the years, it gained momentum, becoming a crucial component of poverty mitigation in India. By March 2006, the number of SHGs had reached approximately three million, with 1.6 million linked to banks. The essence of the SHG movement shifted beyond just providing credit; it became about managing savings and fostering financial independence. MYRADA highlighted the social impact of SHGs, emphasising their role in overcoming societal hurdles.

In 1999, the Indian government introduced the Swarn Jayanti Gram Swarozgar Yojana (SGSY) to promote self-employment in rural areas through the formation and skill development of SHGs. This program evolved into a national movement in 2011, becoming the National Rural Livelihoods Mission (NRLM), the largest poverty alleviation program in the world.

SHG-Bank Linkage Programme Progress (2000-2005):

As we entered the new millennium, the SHG-Bank Linkage Programme showcased significant progress. By March 2005, it had provided credit to over 1.6 million SHGs, benefiting around 120 million people. Cumulative bank loans exceeded a whopping 68 billion rupees, with an impressive over 95% on-time repayment reported by participating banks. The outreach of the program expanded, witnessing the formation of new SHGs and the provision of repeat financing to existing ones. The numbers told a compelling story of empowerment and financial inclusion.

Role of Government Schemes in Growth and Development Of SHG’s

Schemes collectively played a pivotal role in the establishment and growth of SHGs in India, providing a structured framework for financial inclusion, skill development, and socio-economic empowerment.

Deendayal Antyodaya Yojana – National Rural Livelihoods Mission (DAY-NRLM)

- Role: DAY-NRLM, launched by the Ministry of Rural Development, is a flagship program that focuses on promoting self-employment and organising rural poor, especially women.

- Impact: It has mobilised millions of women into SHGs, providing them with financial inclusion, livelihood opportunities, and social empowerment.

NABARD’s SHG Bank Linkage Program

- Role: Initiated by the National Bank for Agriculture and Rural Development (NABARD), this program aimed to link SHGs with formal banking institutions, facilitating credit access for the rural poor.

- Impact: It played a crucial role in mainstreaming SHGs into the formal financial sector, ensuring sustainable financial support for their activities.

Rashtriya Mahila Kosh (RMK)

- Role: RMK, under the Ministry of Women and Child Development, provides microfinance support to women’s groups and NGOs, encouraging the formation and growth of SHGs.

- Impact: It has been instrumental in extending financial aid to SHGs, particularly in areas where formal banking penetration is limited.

Swayamsiddha Scheme

- Role: Launched by the Ministry of Rural Development, this scheme focuses on empowering women through the formation of SHGs, skill development, and income-generating activities.

- Impact: It has contributed to the socio-economic upliftment of women in rural areas by fostering entrepreneurship and financial independence.

Mahila Kisan Sashaktikaran Pariyojana (MKSP)

- Role: MKSP, initiated by the Ministry of Agriculture and Farmers Welfare, targets women in agriculture by forming SHGs and providing them with the necessary resources and training.

- Impact: It addresses the specific needs of women in the agriculture sector, promoting their participation in farming activities and enhancing their income.

National Urban Livelihoods Mission (NULM)

- Role: NULM, focusing on urban poverty alleviation, promotes the formation of SHGs among the urban poor and provides them with skill development and livelihood opportunities.

- Impact: It extends the SHG model to urban areas, catering to the unique challenges faced by the urban poor.

Swarnajayanti Gram Swarozgar Yojana (SGSY)

- Role: SGSY, a poverty alleviation program, encouraged the formation of SHGs in rural areas and provided them with financial support for income-generating activities.

- Impact: It played a key role in the early stages of SHG promotion, laying the groundwork for subsequent initiatives.

Micro Units Development and Refinance Agency (MUDRA) Yojana

- Role: MUDRA Yojana, launched by the Government of India, provides financial support to micro-enterprises, including those led by SHGs, fostering entrepreneurship.

- Impact: It complements SHG efforts by offering financial assistance to small businesses and micro-entrepreneurs.

Shift from the National Rural Livelihood Mission (NRLM) to State Rural Livelihood Missions (SRLMs)

The shift from the National Rural Livelihood Mission (NRLM) to State Rural Livelihood Missions (SRLMs) concerning Self-Help Groups (SHGs) marked a strategic decentralisation in the implementation of livelihood programs. NRLM, launched at the national level, set the overarching framework and guidelines for promoting SHGs and livelihood activities across the country. As the program evolved, the need for tailored interventions at the state level became apparent, considering the diverse socio-economic contexts and regional variations. This led to the establishment of State Rural Livelihood Missions, which operate under the broader umbrella of NRLM but have the flexibility to customise strategies based on local requirements. State-level implementation allows for better alignment with state-specific priorities, resources, and challenges, ensuring a more targeted and effective approach to SHG development. SRLMs play a pivotal role in adapting national policies to local needs, fostering greater community engagement, and optimising the impact of SHGs in the socio-economic landscape of each state.

Today, State Rural Livelihood Missions (SRLMs) are operational in 29 states and 5 union territories, excluding Delhi and Chandigarh. NRLM has played a crucial role in ensuring that the economically disadvantaged have access to affordable, cost-effective, and reliable financial services, including financial literacy, bank accounts, savings, credit, insurance, remittance, pension, and counselling on financial services.

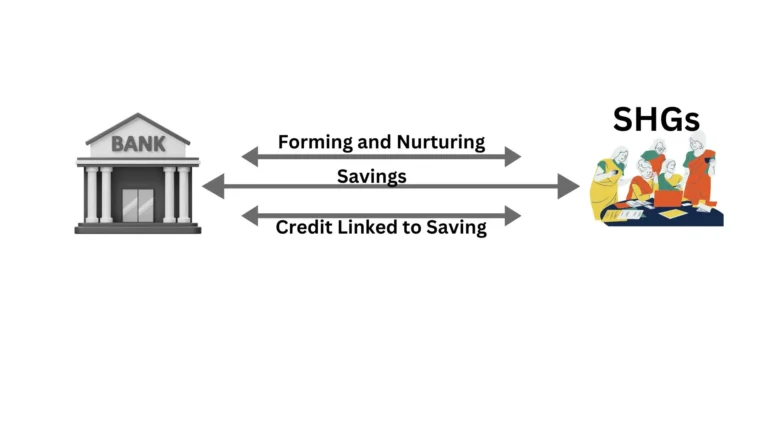

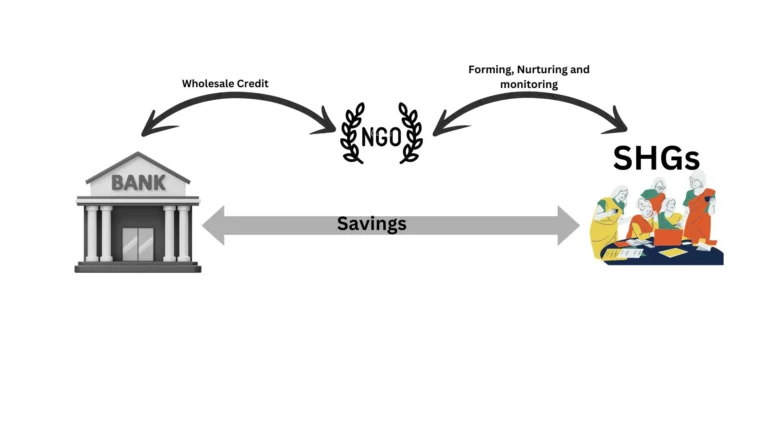

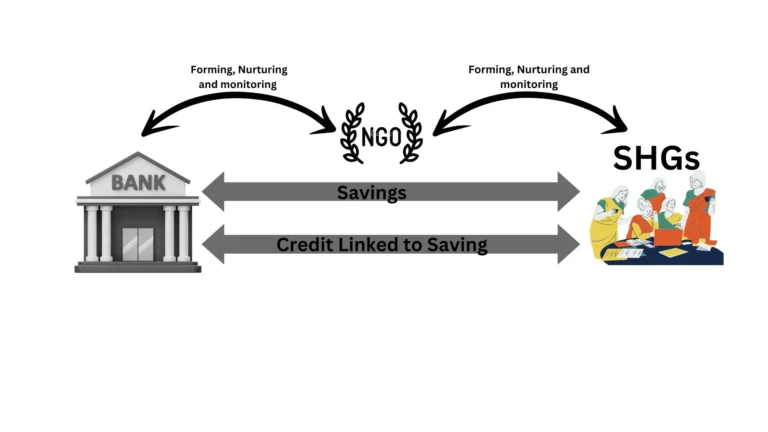

Three distinct models of SHGs linkage to financial institutions

- Banks independently establish and fund the SHGs.

2. SHGs, orchestrated by NGOs and diverse agencies, receive financial support from banks.

3. Banks extend financial support to SHGs, facilitated by NGOs and other intermediary agencies.

Role of Self-Help Group in India

Self-help groups (SHGs) are mainly composed of women. They come together in small collectives to pool their savings and access financial assistance.

- SHGs consist of 15-20 members who meet regularly and contribute savings, ranging from Rs. 25 to Rs. 100 per member.

- After consistent savings for more than a year, the SHG becomes eligible for loans from a bank. These loans are granted in the group’s name and are aimed at creating self-employment opportunities for the members.

- Members have access to small loans from the group to meet their individual needs with lower interest rates without depending on moneylenders.

- Decisions regarding savings, loans, and their terms are made collectively by the group members.

- The group collectively addresses any issues of non-repayment of loans by a member.

Functions of Self-Help Group

Savings and Thrift:

- SHG members regularly save a small amount, cultivating a habit of continuous and disciplined savings.

- “Savings first – Credit later” is the guiding principle for all SHG members.

Internal Lending:

- SHGs utilise the pooled savings to provide loans to their members.

- The group collectively decides on loan purposes, amounts, interest rates, and repayment schedules.

- Proper financial records are maintained by the SHG to track lending and repayment activities.

Problem-Solving:

- SHGs encourage members to discuss and collectively address the challenges and issues faced by their fellow members.

- Through this mutual support, members can find solutions to their individual problems, leveraging the strength of the group.

Accessing Bank Loans:

- SHGs have the ability to borrow funds from banks.

- These bank loans are then provided to SHG members, helping them access credit for various income-generating activities and development needs.

Benefits of Self-Help Group

- Economic Empowerment: Example: In rural Rajasthan, women in SHGs have initiated small-scale businesses like dairy farming and handicraft production, significantly increasing their household incomes. These income-generating activities have helped them achieve economic independence.

- Skill Development: Example: In Tamil Nadu, SHGs have trained women in traditional weaving techniques, enabling them to create high-quality handwoven fabrics. This skill development has transformed them into skilled artisans with a sustainable livelihood.

- Financial Inclusion: Example: In Karnataka, SHGs have facilitated access to microcredit from local banks, enabling members to invest in agricultural activities. This financial inclusion has led to improved crop yields and increased farm income.

- Asset Ownership: Example: In Odisha, SHG members collectively purchased milking cows using their savings. The ownership of these assets has provided a steady source of income through the sale of milk and increased the economic stability of the members.

- Livelihood Diversification: Example: In West Bengal, women in SHGs have diversified their income sources by engaging in poultry farming, vegetable cultivation, and running small grocery stores. This diversification has reduced their dependency on a single source of income.

- Social Networks: Example: In Kerala, SHG members have established strong social networks within their groups. These networks offer support during crises, such as floods and natural disasters, where members come together to provide relief and assistance to affected community members.

- Awareness and Education: Example: In Andhra Pradesh, SHGs have conducted awareness campaigns on sanitation and hygiene in their communities. Through these initiatives, they have improved community awareness and participation in hygiene practices.

- Community Impact: Example: During the COVID-19 pandemic, SHGs across India, such as the “Kudumbashree” in Kerala, played a pivotal role in producing masks, distributing essential goods, and providing meals to the needy, demonstrating their significant impact on community well-being.

- Political Empowerment: Example: In Haryana, women engaged in SHGs have gained greater awareness of their rights and have started participating in local panchayat (village council) elections, increasing their political representation at the grassroots level.

- Resilience During Crises: Example: During the nationwide lockdowns due to the COVID-19 pandemic, SHGs in Himachal Pradesh organised local kitchens to ensure that vulnerable individuals had access to food, showcasing their resilience and adaptability in crisis situations.

- Rural Transformation: Example: In Maharashtra, SHGs have been involved in initiatives to promote sustainable agricultural practices, watershed management, and rural infrastructure development, contributing to long-term rural transformation in the state.

Challenges Faced by SHG's: Examples and Data from Various Regions

- Lack of Information and Direction: Members struggle to choose practical means of subsistence due to a lack of information and guidance, especially affecting women constrained by societal norms. For example, in a study in Punjab, women in SHGs expressed challenges in identifying viable income-generating activities due to limited exposure and guidance.

- Rural Banking Infrastructure: Despite over 6 lakh villages and 1.2 lakh bank branches, the lack of rural banking infrastructure and high service costs hinder financial support for SHGs. In a survey, it was found that the distance of banks from SHGs in certain areas of Punjab posed a significant barrier, discouraging financial transactions.

- Operational Sustainability: SHGs rely on trust, but maintaining standards during the transition from microfinance to micro-entrepreneurship poses challenges, including a loss of understanding of core business values. Case studies reveal instances where SHGs faced difficulties in upholding their cooperative principles as they shifted from microfinance to entrepreneurial ventures.

- Psychological Challenges: Trust issues among SHG members, conflicts arising during success, and difficulties in sustaining cohesiveness impact the group’s progress. Anecdotal evidence suggests that internal conflicts over profit distribution and management often arise when SHGs experience financial success.

- Social Challenges: Patriarchal societal norms in Punjab limit support from family and spouses, hindering women’s participation in SHGs and impeding social and economic upliftment. Interviews with SHG members in Punjab highlighted instances where women faced resistance from family members to actively engage in SHG activities.

- Legal Hassles: Legal limitations, such as the 20-member cap for SHGs and inadequate support for transitioning from microfinance to micro-enterprises, pose obstacles. Real examples include SHGs struggling to expand due to legal constraints, limiting their potential impact.

- Education and Literacy Levels: Low literacy levels among SHG members limit their understanding and engagement, impacting leadership availability, legal compliance, and social issues. Statistical data indicates that a significant percentage of SHG members in Punjab have education levels up to secondary school, affecting their ability to comprehend and address challenges.

- Lack of Leadership: Limited leadership qualities among group members, stemming from low education and confidence levels, hinder the commitment and growth of SHGs. Interviews with SHG members in Punjab revealed a reluctance to take up leadership roles due to a lack of confidence and educational background.

- Marketing Challenges: Despite good products, SHGs face marketing challenges, including a lack of expertise, difficulty negotiating with market channels, and inadequate pricing strategies. A study highlighted instances where SHGs struggled to market their products effectively, limiting their reach and profitability.

- Marketing Challenges: Lack of marketing resources, raw material access, and competition with established players hamper SHGs’ income generation and growth. Real-world examples include instances where SHGs faced difficulties in accessing raw materials at competitive prices, affecting the viability of their ventures.

Data / Statistics

Economic Survey 2022-2023:

- Total Number of SHGs: India has approximately 12 million SHGs, with 88% of them being all-women-member groups.

- In the financial year 2022, approximately 1.27 million self-help groups (SHGs) were digitized under Project EShakti. This initiative aimed to digitize both financial and non-financial data of SHGs.

- Formation Year of SHG-BLP: The SHG Bank Linkage Project (SHG-BLP) was initiated in 1992 to link these groups with banks for the disbursal of small loans for livelihood development.

- World’s Largest Microfinance Project: As of 2022, SHG-BLP is considered the world’s largest microfinance project, covering 142 million families.

- Total Savings Deposits: These SHGs have accumulated savings deposits of Rs 47,240 crore.

- Growth in SHGs: The number of SHGs credit linked has grown at a Compound Annual Growth Rate (CAGR) of 10.8% over the last ten years (from FY13 to FY22).

- Credit Disbursement Growth: Credit disbursement per SHG has grown at a CAGR of 5.7% during the same period.

- Loan Repayment: Notably, more than 96% of SHGs’ bank repayment rates are observed, indicating their credit discipline and reliability.

- Impact of COVID-19: In response to the COVID-19 pandemic, the government increased the collateral-free loan limit for SHGs to Rs 20 lakh from Rs 10 lakh in 2021. This change reportedly benefited 6.3 million women SHGs and 68.5 million households.

Government Schemes and Initiatives

Achievements under Deendayal Antyodaya Yojana(2022) – National Rural Livelihoods Mission (DAY-NRLM) in empowering women through the formation of Self-Help Groups (SHGs).

SHG Formation and Mobilization:

- Total Women Mobilised: 8.71 Crore women from poor and vulnerable communities.

- Total SHGs Formed: Nearly 81 lakh SHGs, with 6.82 lakh formed in the year 2022.

Capitalization Support:

- Community Investment Support Fund (CISF): Approximately Rs. 19,707.24 Crore provided to institutions of rural poor women under the mission. In 2022, Rs. 3,876.70 Crore was provided to SHGs as CISF.

SHG-Bank Credit Linkage:

- Credit Access: 35.87 lakh SHGs accessed an annual credit linkage amounting to Rs. 88,955.57 Crore in the current year. Since FY 2013-14, women SHGs have accessed Rs. 5.90 Lakh Crore from banks.

- Non-Performing Assets (NPA): The NPA decreased significantly from 23% prior to the mission to 2.22% in the current year, reflecting improved repayment efforts by SHGs.

Business Correspondent Agents (BCAs):

- BC Sakhi Deployment: 102,558 SHG members have been trained and certified as BC Sakhi, providing digital banking services in rural areas. Around 88,000 have been deployed in the current year.

Livelihood Promotion:

- Farm Interventions: More than 1.96 Crore women farmers have been covered, with 35.35 lakh households benefiting from training and practices enhancing crop and animal productivity.

- Non-Farm Strategy (SVEP): Over 2.21 lakh enterprises have been supported under the Start-Up Village Entrepreneurship Programme, with nearly 29,000 enterprises established during the year.

Major Initiatives in 2022:

- A country-wide campaign mobilised approximately 16 lakh households and formed around 1.30 lakh SHGs.

- Approval of an overdraft facility of Rs. 5,000 for SHG members with PMJDY accounts.

- Revision in the interest subvention scheme to standardise rates and ensure uniformity across the country.

- Amendments in the master circular of RBI to raise the minimum levels of bank linkage for SHGs.

Success Stories of SHGs in India

- Total Number of SHGs: India has approximately 12 million SHGs, with 88% of them being all-women-member groups.

- In the financial year 2022, approximately 1.27 million self-help groups (SHGs) were digitized under Project EShakti. This initiative aimed to digitize both financial and non-financial data of SHGs.

- Formation Year of SHG-BLP: The SHG Bank Linkage Project (SHG-BLP) was initiated in 1992 to link these groups with banks for the disbursal of small loans for livelihood development.

- World’s Largest Microfinance Project: As of 2022, SHG-BLP is considered the world’s largest microfinance project, covering 142 million families.

- Total Savings Deposits: These SHGs have accumulated savings deposits of Rs 47,240 crore.

- Growth in SHGs: The number of SHGs credit linked has grown at a Compound Annual Growth Rate (CAGR) of 10.8% over the last ten years (from FY13 to FY22).

- Credit Disbursement Growth: Credit disbursement per SHG has grown at a CAGR of 5.7% during the same period.

- Loan Repayment: Notably, more than 96% of SHGs’ bank repayment rates are observed, indicating their credit discipline and reliability.

- Impact of COVID-19: In response to the COVID-19 pandemic, the government increased the collateral-free loan limit for SHGs to Rs 20 lakh from Rs 10 lakh in 2021. This change reportedly benefited 6.3 million women SHGs and 68.5 million households.

1.SEWA (Self-Employed Women’s Association)

SEWA, founded in 1972 by Ela Bhatt in Gujarat, is one of the most renowned self-help groups in India. It started with a handful of women who came together to support each other in their economic pursuits. SEWA focused on organizing women working in the informal sector, providing them with access to credit, skills training, and market linkages. Over the years, SEWA has grown into a large trade union and cooperative, empowering millions of women across India to improve their livelihoods and advocate for their rights.

2.Kudumbashree

Kudumbashree, initiated by the Government of Kerala in 1998, is a community-based poverty eradication program that mobilizes women into neighborhood groups. These groups undertake various income-generating activities, including micro-enterprises, agriculture, and handicrafts. Kudumbashree provides training, credit, and marketing support to these groups, enabling them to become self-reliant. Today, Kudumbashree is recognized as one of the largest women’s empowerment programs in India, with millions of women actively participating in its activities.

3.Bharatiya Yuva Shakti Trust (BYST)

BYST, founded in 1992, is a non-profit organization that supports young entrepreneurs from economically disadvantaged backgrounds. It provides training, mentoring, and financial assistance to help them start and grow their businesses. BYST’s innovative approach to entrepreneurship development has empowered thousands of young people across India to become successful entrepreneurs, creating employment opportunities and contributing to economic growth.

4.Mahila Arthik Vikas Mahamandal (MAVIM)

MAVIM, established in Maharashtra in 1994, focuses on empowering women through economic self-sufficiency. It promotes the formation of SHGs among women from marginalized communities and provides them with training in various income-generating activities such as tailoring, food processing, and animal husbandry. MAVIM also facilitates access to credit and markets, enabling women to increase their income and improve their standard of living.

5.Grama Vikas

Grama Vikas, operating in Odisha since 1979, works towards sustainable rural development through community participation. It mobilizes villagers to form SHGs and undertake initiatives related to agriculture, water management, sanitation, and health. Grama Vikas emphasizes women’s leadership and empowerment, with SHGs playing a central role in decision-making and implementation of development projects. Through its participatory approach, Grama Vikas has transformed numerous villages in Odisha, improving the lives of thousands of rural residents.

6.Deccan Development Society (DDS)

DDS, based in Telangana, works with tribal and marginalized communities to promote sustainable agriculture, biodiversity conservation, and women’s empowerment. It facilitates the formation of SHGs among women and provides them with training in organic farming, seed preservation, and marketing. Through collective action and community-led initiatives, DDS has revitalized traditional farming practices, restored degraded land, and empowered women to become leaders in their communities

7.Dhriiti – The Courage Within

Dhriiti is a non-profit organization based in Delhi that empowers young entrepreneurs through capacity building, mentorship, and access to finance. It facilitates the formation of SHGs among aspiring entrepreneurs and provides them with entrepreneurship training and incubation support. Dhriiti’s innovative programs have helped thousands of young people across India to start and scale their businesses, creating employment opportunities and driving economic growth.

8.Usha Silai School

UshaSilai School, launched by Usha International, aims to empower women in rural areas by providing them with sewing and tailoring skills. It operates a network of Silai Schools, where women are trained to become master trainers and impart sewing skills to other women in their communities. Through this initiative, women gain financial independence, improve their livelihoods, and contribute to the socio-economic development of their villages.

9.Mann Deshi Foundation

Mann Deshi Foundation, operating in Maharashtra, focuses on empowering rural women entrepreneurs through financial literacy, business training, and access to finance. It facilitates the formation of SHGs and provides them with microfinance services, business development support, and market linkages. Mann Deshi’s holistic approach to women’s empowerment has enabled thousands of women to start and grow their businesses, break the cycle of poverty, and become change-makers in their communities.

10.Aajeevika Bureau

Aajeevika Bureau, based in Rajasthan and Gujarat, works with migrant workers and their families to address issues related to migration, livelihoods, and social protection. It facilitates the formation of SHGs among migrant women and provides them with support services such as financial literacy, access to social entitlements, and skills training. Aajeevika Bureau’s interventions have improved the economic and social well-being of migrant communities, enabling them to lead dignified lives in their places of origin.

Previous Year Questions on SHG's

Q. The legitimacy and accountability of Self-Help Groups (SHGs) and their patrons, the micro-finance outfits, need systematic assessment and scrutiny for the sustained success of the concept. Discuss. 10M (2013)

Q. The penetration of Self-Help Groups (SHGs) in rural areas in promoting participation in development programmes is facing socio-cultural hurdles. Examine. 12.5M (2014)

Q. The Self-Help Group (SHG) Bank Linkage Programme (SBLP), which is India’s own innovation, has

proved to be one of the most effective poverty alleviation and women empowerment programmes. Elucidate. 12.5M (2015)

Q. ‘The emergence of Self-Help Groups (SHGs) in contemporary times points to the slow but steady withdrawal of the state from developmental activities. Examine the role of the SHGs in developmental activities and the measures taken by the Government of India to promote the SHGs. 15M (2017)

Indian Missile System

Indian Missile System Table of Contents Missile Systems A missile is a self-propelled, guided weapon system designed to deliver a payload to a specific target.

Mindset Behind IAS Akash S.’s 204 UPSC Interview Score in 2019

The Mindset and Methodology Behind Akash S.’s 204 Interview Score in IAS 2019 Note: I am attempting to write my transcript after 5 years. My

Cooperative Society (Introduction, Roles, Types, Examples)

Cooperative Society A cooperative society is a group of people who come together to help each other and boost their economic well-being. It’s like a

Pressure Groups (Types, Features, Examples)

Pressure Groups Pressure groups refers to an organised assembly of individuals aiming to influence public opinion or government policies and actions. These groups encompass a

NGO’s and Voluntary Organisation (Introduction, Roles, Features, Challenges)

NGO’s and Voluntary Organisation Non-Governmental Organizations (NGO’s) have played a crucial role in the development landscape of India, contributing significantly to social welfare, empowerment, and

UPSC Essay Analysis

Candidates may be required to write essays on multiple topics. They will be expected to keep closely to the subject of the essay to arrange